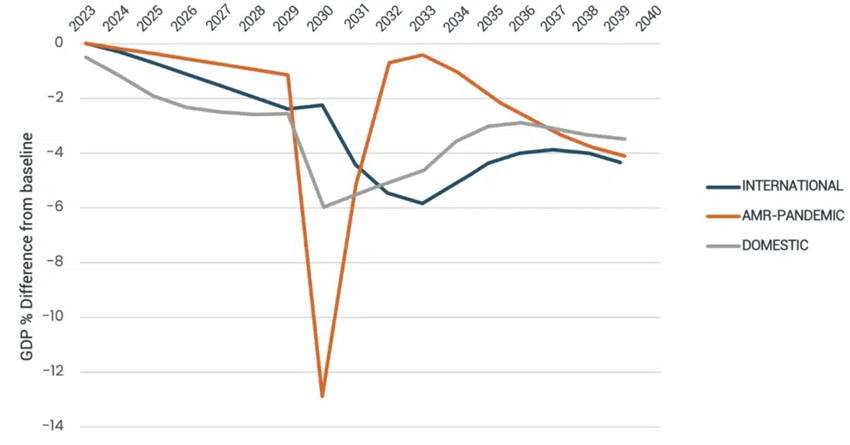

The deterioration of the UK’s natural environment could lead to an estimated 12% loss to GDP, according to new analysis. In comparison, the financial crisis of 2008 took around 5% off the value of the UK GDP, while the Covid-19 pandemic cost the UK up to 11% of its GDP in 2020.

This is according to a first-of-its-kind analysis, led by the GFI, with input from the scientific and financial community, as well as direction from the Department for Environment, Food and Rural Affairs (Defra), HM Treasury (HMT) and the Taskforce on Nature-related Financial Disclosures (TNFD), and input from the Financial Conduct Authority (FCA). The report – Assessing the Materiality of Nature-Related Financial Risks for the UK – analyses the impact of the degradation of natural ecosystems, both domestically and internationally, to the economy and financial sector in the UK.

Helen Avery, Director, Nature Programmes and GFI Hive, said, “The analysis that shows nature degradation will wipe billions of pounds off of UK GDP and threaten financial resilience. Intuitively we know that the continued degradation of nature harms our collective prosperity, but this is the first time it has been quantified.

“The results are beyond what we imagined, and they’re already happening. The degradation to UK’s nature may have a greater impact on our GDP than the Global Financial Crisis in the coming decade, with a 3% hit by the late 2020s alone. Our exposure to international nature-related risks could also cost us 6% off of GDP. Preliminary evidence also suggest in this report that our banks are vulnerable.”

The analysis shows that nature-related risks are as detrimental to the economy as those from climate risks. Yet, while the economic costs of climate change are becoming increasingly accepted, the risks posed by nature degradation amount to a material cost that has not been sufficiently factored into financial and business decision-making.

This is leaving the economy and financial sector exposed, while these risks continue to rise unchecked.

The UK is one of the most nature-depleted countries in the world – three quarters of the UK has a high level of ecosystem degradation, with risks to financial services and the wider economy as a result. The analysis shows however, that half of the UK’s nature-related financial risks originate overseas.

Within the analysis, a new inventory charts these domestic and international nature-related risks to the economy, many of which are not currently captured in national risk assessments. The inventory captures financial risks arising from the deterioration of nature and biodiversity, including: soil health decline,, water shortages, global food security repercussions, zoonotic diseases that pass from animals to humans, like bird flu, swine flu, and Covid-19, and antimicrobial resistance, where bacteria and viruses no longer respond to medicines, as well as transition and litigation risks.

The report shows that some sectors in particular face higher levels of nature-related financial risk. Highlighted in the analysis are agriculture, manufacturing, and utilities. For example, the agricultural sector faces risks associated with water, climate regulation, soil quality, and pollution which could impact food production. The utilities sector is dependent on surface water for cooling power stations, and any constraint in water supplies could impede production and raise energy prices.

These impacts on the real economy will also have a material financial impact on banks and other financial institutions. The analysis estimates that some banks could see reductions in the value of their domestic portfolios of up to around 4 – 5% in some cases. Noting that these estimates are likely to be conservative, this indicates that nature-related risk will not just impact the economy, but potentially financial resilience.

Demonstrating the significance of the risks, these findings present an opportunity for swift action from governments, central banks, regulators and the financial sector to proactively manage nature-related risks and to position the UK as a global leader in addressing them. For businesses there are early-mover advantages for those that act to improve and support resiliency, particularly within their supply chains.

Beccy Speight, Chief Executive of the RSPB said, “We are in a Nature and Climate Emergency, and as this report by the Green Finance Institute further proves, we simply cannot afford to leave nature in freefall. Over half of our economy is dependent on nature – it pollinates our crops, provides us with raw materials, gives us clean air and water and, when invested in, can provide quality nature-based solutions to adapt to the impacts of climate change.

“Governments must heed the stark warning this report provides and lead the way in nature investment in order to catalyse the change we need to see across the economy, including from central banks, financial institutions, regulators and businesses. A more ambitious plan from governments to deliver more public and private investment in nature is urgently needed, because nature can’t wait.”

The GFI and technical team make several recommendations for the public and private sectors. These include disclosures of nature-related risks and taking urgent action to meet the targets included within the Global Biodiversity Framework (GBF).

Soil Association Policy Director, Brendan Costelloe, responded to the report. He said, “This report shows that we cannot survive without nature and highlights the folly of investing in industrial farming practices that deplete the wildlife we depend on to produce food. UK food production, and every business which depends on that, is threatened by the catastrophic declines in wildlife we are seeing and by degradation of one of our most vital resources for survival – soil.

“Farmland makes up 70% of Britain and we can’t fix the decline in nature and reduce the associated financial risks without a transformation in food and farming. Many farmers are working with nature and many more are keen to do. But we remain too dependent on over-intensive, chemical-reliant methods that destroy habitats such as industrial livestock systems fed on imported soy.

“These new findings are a rallying call to investors to back nature-friendly farming. If they want to safeguard our precious natural capital and secure long-term returns on their investments, they must divest from agricultural practices that drive biodiversity decline, and invest in agroecological and organic farming that allows food production and nature to flourish together, while also delivering resilience in the face of climate change.

“It is also vital that the government acts on its promise to deliver a land use framework, which can help to scale agroecological farming across the country and give greater protection from harmful farming to sensitive locations. The consequences of not acting now are dire, for the whole of society.”

Read the report, Assessing the Materiality of Nature-Related Financial Risks for the UK