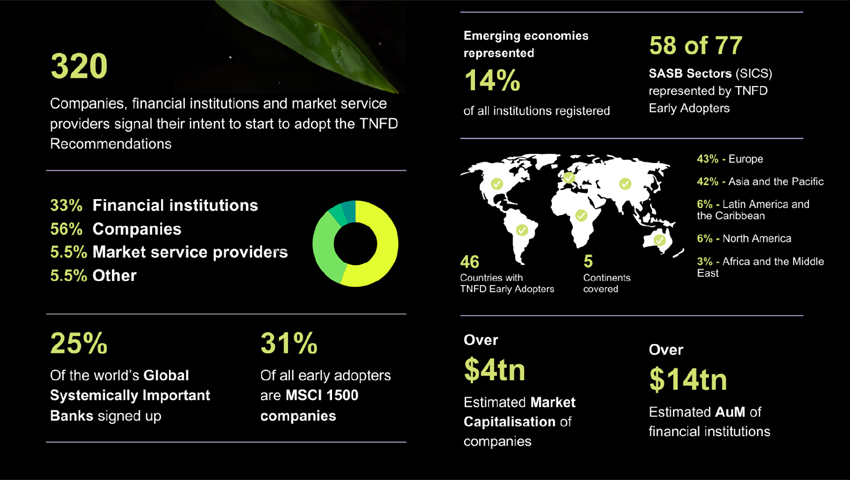

The Taskforce on Nature-related Financial Disclosures (TNFD) is delighted to announce that 320 organisations from over 46 countries have committed to start making nature-related disclosures based on the TNFD Recommendations published in September last year.

This first cohort of adopters of the TNFD Recommendations includes leading publicly listed companies across geographies and industry sectors representing US$4 trillion in market capitalisation; over 100 financial institutions, including some of the world’s largest asset owners and managers, representing US$14 trillion in Assets under Management (AUM) as well as banks, insurers and other leading market intermediaries such as stock exchanges and audit and accounting firms.

These organisations have signalled today their intention to begin adopting the TNFD Recommendations and publishing TNFD-aligned disclosures as part of their annual corporate reporting for FY2023, FY2024 or FY2025.

The organisations announced today as part of this first cohort of TNFD adopters are headquartered in over 46 countries. Among the notable financial institutions are NBIM (the largest single owner in the world’s stock markets, owning almost 1.5% of all shares in the world’s listed companies), as well as 7 of the 29 Globally Systemically Important Banks (GSIBs).

The announcement was made today at an Issue Briefing event at the Annual Meeting of the World Economic Forum on Tuesday 16th January 2024.

David Craig, Co-Chair of the TNFD and former founder and CEO of Refinitiv, said, “This is a milestone moment for nature finance and for corporate reporting. As climate-related sustainability reporting goes mainstream through the new International Sustainability Standards Board (ISSB) standards and regulation in a growing number of countries, this is a clear signal that investors, lenders, insurers and companies are recognizing that their business models and portfolios are highly dependent on both nature and climate and need to be treated as both strategic risks and investment opportunities. We are delighted to see such a strong, diverse and international group of companies and financial institutions step forward only four months after the release of our recommendations and look forward to even more stepping forward over the coming months”.

Elizabeth Maruma Mrema, TNFD Co-Chair and Deputy Executive Director of the UN Environment Programme (UNEP) added, “Twelve months ago the world came together to agree to the Global Biodiversity Framework to halt and reverse nature loss, including a specific target on corporate reporting. The release of the TNFD recommendations in September last year provided the tools to do that and today we have seen the market commit to start taking action”.

TNFD early adopter statistics

Total: 320

MSCI 1500: 98 (31% of early adopters)

Institution type:

- Companies: 178 (56%)

- Financial Institution: 106 (33%)

- Market Service Provider: 18 (5.5%)

- Other (including NGO, public development, data, public sector, etc.): 18 (5.5%)

Emerging and Developing Economies: 45 (14%)

Regional breakdown:

- Europe: 137 (43%)

- Asia and the Pacific: 134 (42%)

- North America: 21 (6%)

- Latin America and the Caribbean: 18 (6%)

- Africa and the Middle East: 10 (3%)

Country breakdown:

- 46 countries and territories represented

SASB Sector (SICS) overview:

- 58 sectors represented (out of 77)

Background on the TNFD recommendations:

The TNFD was launched in June 2021 with the support of G20 and G7 governments.

- The TNFD corporate reporting recommendations on nature-related issues were published in September 2023 after a 2-year design and development process led by the TNFD’s 40 Taskforce members and supported by 20 knowledge partners with global market input and participation.

- The 14 recommended disclosures follow the approach and structure developed by the Taskforce on Climate-related Financial Disclosures (TCFD) launched by Michael Bloomberg and Mark Carney in December 2015.

- The TNFD Recommendations have been designed to enable the achievement of the global policy goals outlined in the Kunming-Montreal Global Biodiversity Framework agreed to by 196 countries at the Convention on Biological Diversity (CBD) COP15 held in Montreal in December 2022.

- They have also been designed to be consistent with the new S1 and S2 standards on sustainability reporting published in mid-2023 by the International Sustainability Standards Board (ISSB) as well as existing nature and biodiversity impact reporting standards provided to market participants by the GRI.

- Over 250 institutions worldwide pilot tested the TNFD’s proposed approach during its design and development phase.